Time series modelling of inflation and consumer price index trends in Nigeria

Keywords:

Inflation, ARIMA models, GARCH models, Cointegration, Monetary policy transmissionAbstract

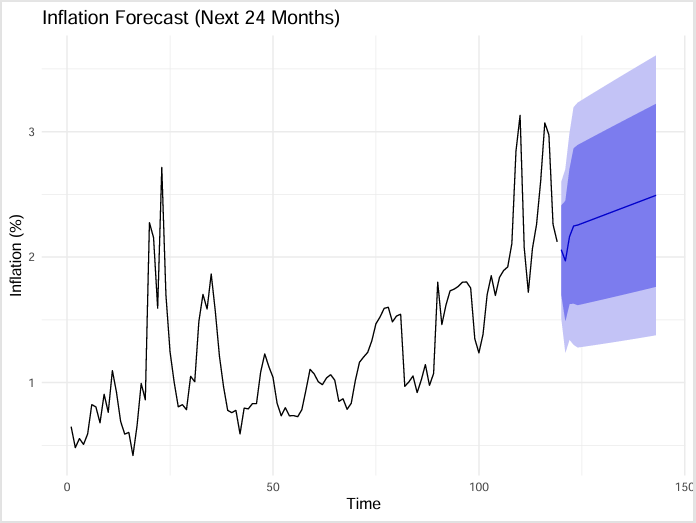

Inflation is a long-term, steady rise in the average price of goods and services. Its volatility weakens purchasing power, distorts income distribution, discourages investment and savings, and threatens macroeconomic stability. This study examined the relationship between the Consumer Price Index (CPI) and Financial Institutions’ Credit Deposit (FICD) ratio using regression, ARIMA, and GARCH models to forecast inflation. Data from the National Bureau of Statistics (2015-2024) and Central Bank of Nigeria were analyzed. Descriptive results showed high variability in inflation (mean = 1.29%, SD = 0.59, skewness = 1.05) and moderate variability in FICD (mean = 8.69, SD = 2.62, skewness = 0.36). Regression results indicated a negative but insignificant effect of FICD on inflation (β = −0.0177, p = 0.3977). The Augmented Dickey-Fuller test confirmed stationarity (p = 0.01). ARIMA(2,2,1) captured inflation persistence, while GARCH(2,3) identified mild volatility. Johansen cointegration tests revealed no long-run equilibrium among CPI, inflation, and FICD. Findings suggest that structural and cost-push factors drive inflation, requiring stronger monetary transmission and efficient credit allocation for price stability.

Published

How to Cite

Issue

Section

Copyright (c) 2025 Benson Ade Eniola Afere, Yahaya Baba Usman, Ekele Alih, Ekele Vincent Aguda, Latifat Enesi

This work is licensed under a Creative Commons Attribution 4.0 International License.