Integrative approaches of multivariate convolutional neural networks with a dynamic conditional correlation model for forecasting stock market volatility

Keywords:

Volatility models, machine learning approaches, Artificial neural networks, Hybrid models, Time series analysisAbstract

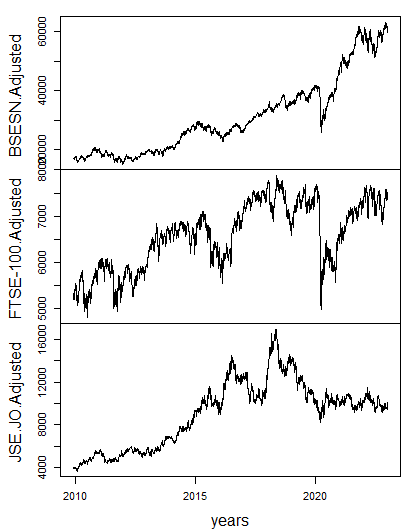

Machine learning and deep learning approaches have been extensively studied across various fields, significantly contributing to the successful resolution of numerous problems. Examples include image classification, computer vision applications, and natural language processing. Owing to their powerful capabilities, they have not only made significant contributions in the fields above but also increasingly been applied to time series analysis, particularly in analyzing financial time series to forecast the volatility and correlation among stock markets. Researchers have proposed hybrid models that combine machine learning and deep learning approaches with statistical and econometric models to enhance time series analysis and forecasting. In this work, the dynamic conditional correlation (DCC) model, as an econometric model, and multivariate convolutional neural networks (MCNNs), as deep learning models, are employed to construct hybrid models to enhance the forecasts of dynamic volatility and correlation among stock markets. Two methods are presented for combining the DCC model with the convolutional neural network (CNN) model. The results show that the best way to combine the DCC model and the CNN model is to use the outputs of the CNN model as inputs to the DCC model. The hybrid DCC-MCNN model demonstrates stronger performance across both in-sample and out-of-sample accuracy measures, such as the root mean square error (RMSE) and mean absolute error (MAE). Specifically, the hybrid DCC-MCNN model emerges as the top performer among the evaluated models, surpassing both the single model approaches and the hybrid MCNN-DCC model in forecasting time-varying volatility and correlation among stock markets.

Published

How to Cite

Issue

Section

Copyright (c) 2025 Anas Eisa Abdelkreem Mohammed, Henry Mwambi, Bernard Omolo

This work is licensed under a Creative Commons Attribution 4.0 International License.